Solutions for Different Financial Sectors

CE Loan SMB

Streamline your online lending for small and medium-sized businesses. Our white-label platform supports the entire lending process, from application to repayment, for both borrowers and your team.

CE Loan Enterprise

Transform your bank's loan operations with our digital solution. Improve communication with customers, reduce manual tasks, and eliminate paperwork.

CE Loan Personal

Enhance your customer experience with our online consumer loan service. Integrate with your existing digital platforms to offer a convenient borrowing experience.

CE Factoring

Automate your online factoring process. Our comprehensive platform supports various invoice factoring and financing services.

CE POS Financing

Elevate your customers' online shopping experience. We provide an agile platform tailored for retailers and service providers.

CE Leasing

Simplify your leasing operations with our fully integrated platform. Manage the entire leasing lifecycle no matter your industry, from automotive to consumer goods.

CE Loan Hoshokyokai

Digitize your Credit Guarantee Corporation (Hoshokyokai) loan application process. Our platform is available to Credit Guarantee Corporations across Japan.

Data Integration

CE DataHub

Consolidate your loan and marketing data in one central hub. We integrate with popular cloud accounting and financial services used by most small and medium-sized businesses.

Credit Scoring

CE Scoring

We develop custom credit scoring models based on data from online financial services, including online banking and cloud accounting platforms.

CE Model2API

Expedite the use of your credit scoring models. We convert your models into APIs for seamless integration with your other loan services.

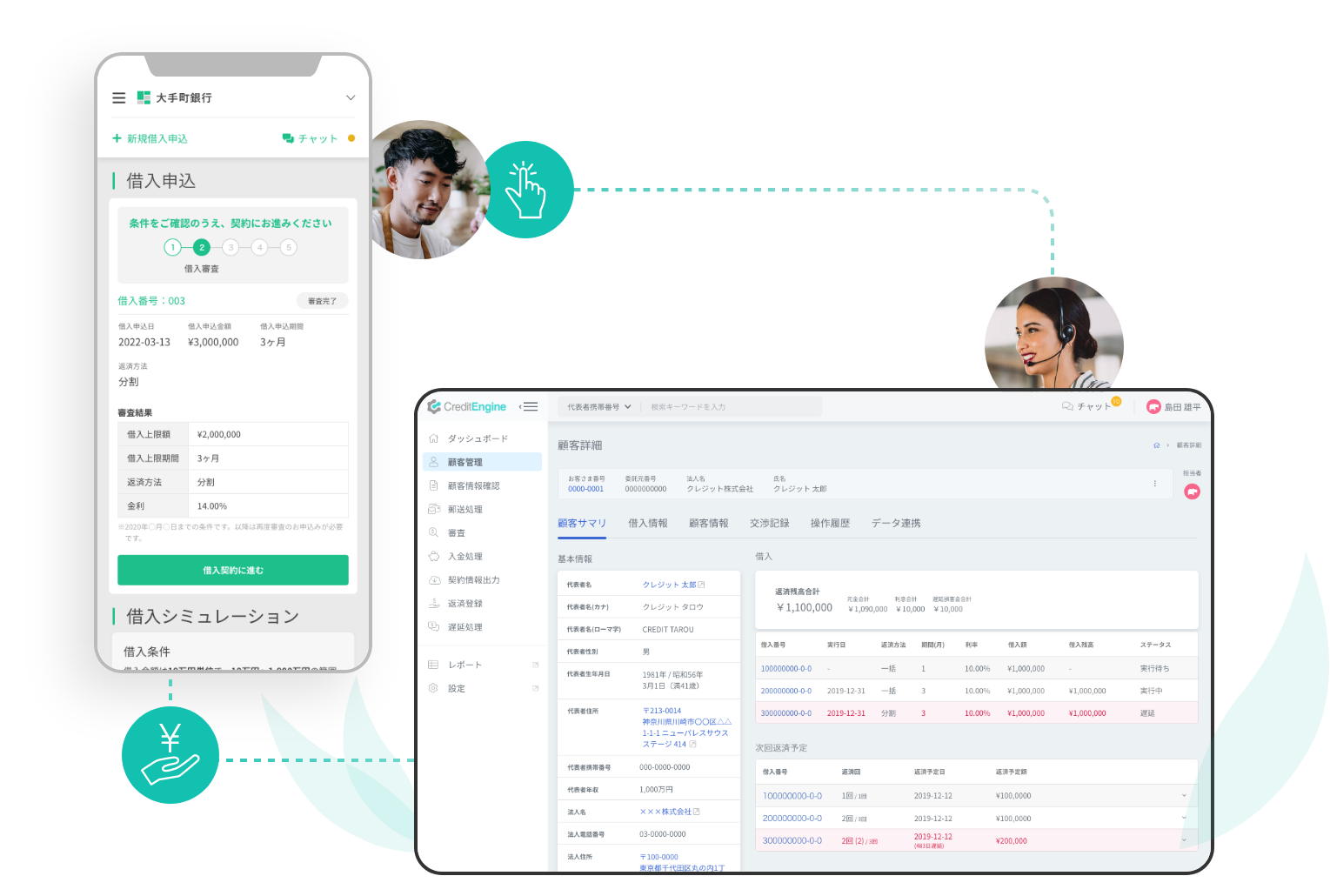

A complete solution for the entire Online Lending process

-

A complete set of essential features for your lending service.

Build both your management site and your user portal with our package. We offer a seamless, end-to-end solution from loan application to debt collection, compliant with relevant regulations.

-

Over 100 customizable settings

Tailor your system based on your business requirements. Our configurations' cover from a range of operational needs such as repayment methods, interest calculation and customer inquiry field to the visual design of your customer platforms.

-

Trusted by major banks for our reliability

Adopted by pioneering online lending service 'LENDY,' as well as by Mitsubishi UFJ Bank and Mizuho Bank.

Lending SaaS

Offer your customers a branded, end-to-end online lending experience. Our customizable back-office system supports the entire lending process and offers over 200 settings for tailored solutions.

For Lenders

- - Clear overview of all loan statuses

- - Comprehensive loan management and reporting

- - Seamless integration with existing systems

- - Optimized for both small and large teams

For Borrowers

- - Effortless Borrowing

- - One-stop shop from application to repayment

- - Secure eKYC identity check

- - Online chat support

More Advanced Features

Report Generation

Harness the power of SQL to create custom reports tailored to your needs. Gain valuable insights by easily tracking key metrics and accessing critical data.

Chat System

Communicate directly with your customers in real-time. All conversations are securely stored in the cloud for easy reference and compliance.

Cloud Data Integration

Access your customers' cloud accounting and other financial data through system integrations.

Customized Credit Scoring Model

Build your own credit scoring model based on online data, tailored to your specific risk appetite. We offer custom support and integration with your existing data sources.

Customizable Decision Procedure

Automate your internal approval process with our customizable workflow feature. Easily define approval flows, assign approvers, and set deadlines for efficient decision-making.

Cloud-based Platform

Leverage our secure and scalable cloud infrastructure for rapid deployment and continuous innovation. Benefit from regular updates and new features.